He argues that this approach, which he says previously made the US “richer” and a more “powerful” economy, would mark a pivotal turning point for the nation.

"America is going to be very rich again, and it's going to happen very quickly," Trump said during a speech in Florida on Monday, Jan. 27 at the 2025 Republican Issues Conference at the Trump National Doral Miami.

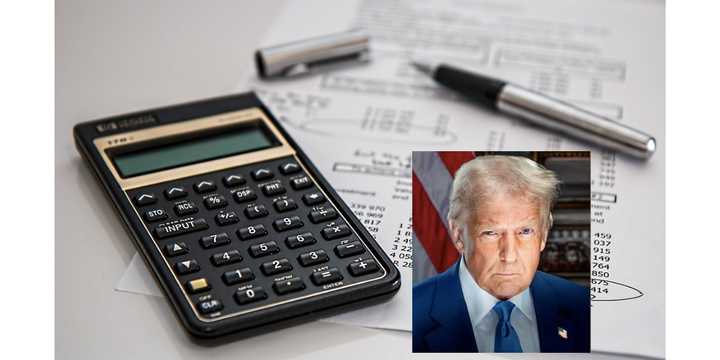

"Instead of taxing our citizens to enrich foreign nations, we should be tariffing and taxing foreign nations to enrich our citizens."

Trump first floated the idea of no income taxes before the November election, including on an appearance with podcaster Joe Rogan.

Many economists question how tariffs could account for the nearly $5 trillion in revenue that the federal government collects in income tax each year.

At the same time, the Trump administration is moving to reduce the size of the federal workforce, which consists of approximately two million civilian employees.

The White House plans to offer buyouts to federal workers who don’t want to return to in-office work, reversing remote work policies from the COVID-19 pandemic.

The buyout package, which includes roughly eight months of salary and benefits, is designed to lower government payroll costs and save taxpayer money.

Estimates suggest that 5 percent to 10 percent of federal employees may accept the offer, potentially saving around $100 billion annually, according to NBC News.

Both proposals have ignited debate. Supporters argue that ending income tax would simplify the system, ease the burden on American workers, and boost domestic manufacturing by making imports more expensive.

However, critics warn that higher tariffs could raise consumer prices, putting more financial strain on low- and middle-income Americans.

The proposed federal job cuts have also raised concerns about the impact on government services.

With thousands of employees potentially taking buyouts, questions remain about how agencies will maintain essential operations — from Social Security processing to veterans’ services.

As these sweeping changes take shape, the full effects will depend on how they are implemented and how lawmakers, federal employees, and the American public respond.

Click here to follow Daily Voice Massapequa and receive free news updates.